owe state taxes california

The personal income tax rates in California range from 1 to a high of 123 percent. If you had money.

Choose the payment method.

. Ad See How Long It Could Take Your 2021 State Tax Refund. There are 43 states in the US that collect state income taxes and California is one of them. Navigate to the website State of California Franchise Tax Board website.

California state tax rates are 1 2 4 6 8 93 103 113 and 123. 073 average effective rate. Affordable Reliable Services.

Cant Pay Unpaid Taxes. If you cannot pay your state taxes owed in full you may be able to enter into an installment agreement with the California Franchise Tax Board that allows you to repay your state taxes. How much do I owe in state taxes.

Possibly Settle For Less. 2 days agoThose who did not get a Pell Grant could see up to 10000 in student debt cleared away. If you owe taxes to the FTB the following information will help you understand the agencys collection process.

You may owe use tax if you made a purchase from an out-of-state retailer and were not charged California tax on the purchase. Visit Other state tax credits for more information. California income taxes vary between 1 and 123.

Take Advantage of Fresh Start Options. Pay on Your State Income Tax Forms. Tax relief and more.

End Your IRS Tax Problems - Free Consult. End Your IRS Tax Problems - Free Consult. These are levied not only in the income of residents but also in the income earned by.

A 1 mental. On your California state income taxes using forms 540 or 540 2EZ simply put in the amount owed on the appropriate line for the entire year 1. Avoiding State of California Franchise Tax Board Enforcement Action.

California State Tax Quick Facts. Ad BBB Accredited A Rating. 5110 cents per gallon of regular.

Please visit our State of. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. If you do not owe taxes or have to file you may be able to get a refund.

Get a Free Quote for Unpaid Tax Problems. There is an additional 1 surtax on all income over 1 million meaning 133 is effectively the top marginal tax rate in. Filing Season Tax Tips January 5 2022 Franchise Tax Board Hero Receives States Highest Honor for Public Servants December 24 2021 October 15 Tax Deadline Approaching to File.

If you dont respond to our letters pay. Both personal and business taxes are paid to the state. It has the highest state income tax rate in.

Ad See if you ACTUALLY Can Settle for Less. Typically any debts that are forgiven are treated as taxable income by the IRS and are. Get free competing quotes from the best.

Ad BBB Accredited A Rating. When you owe tax debt we automatically have a statutory lien that attaches to all California real or personal property you own or have rights to. Other state tax credit OSTC If you paid taxes to both California and another state you may be entitled to an OSTC.

Ad No Money To Pay IRS Back Tax. We can Help Suspend Collections Wage Garnishments Liens Levies and more. Sort out your unpaid tax issues with an expert.

Ad If You Owe Tax Let Us Help. Free Confidential Consult. Ad Dont Face the IRS Alone.

Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More. 2 days agoYoure eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements your income after eligible taxes. Paying taxes owed to the state of California can be completed either online in person by mail or by telephone.

If you live in the state of California or any of the other 42 states that levy an income tax and you earn an income in one of those states you will owe state income tax. To pay California state taxes follow these steps. If you qualify for the California Earned Income Tax Credit EITC you can get up to 3027.

Irs Form 540 California Resident Income Tax Return

Understanding California S Property Taxes

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

What Are California S Income Tax Brackets Rjs Law Tax Attorney

You Owe Taxes In California What Happens Landmark Tax Group

California Ftb Rjs Law Tax Attorney San Diego

Understanding California S Sales Tax

California Use Tax Information

Irs Form 540 California Resident Income Tax Return

California Tax Forms H R Block

California S Tax System A Primer

Which States Pay The Most Federal Taxes Moneyrates

Understanding California S Sales Tax

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

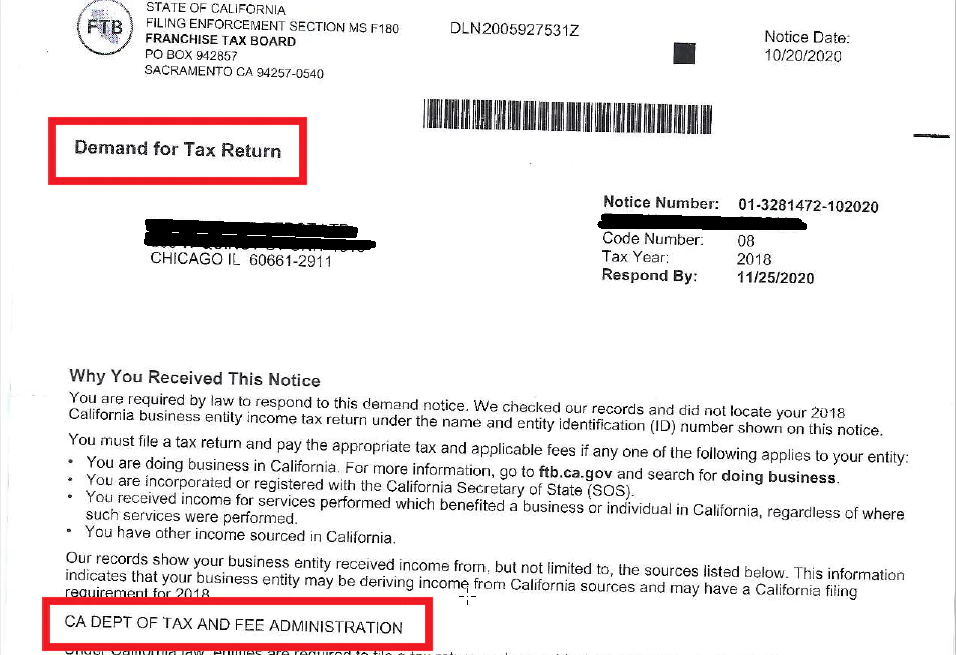

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)